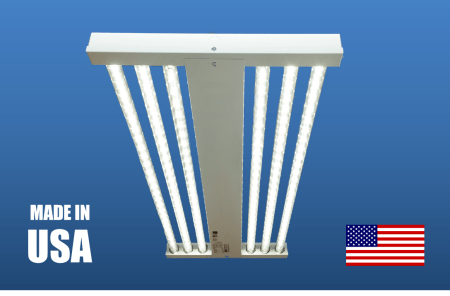

So we’ve made the decision…..we’re converting the parking deck to LED lighting. Considering the money saved on the energy bill, along with the lower maintenance costs accompanied with not putting someone on a bucket truck for the next 10 years to swap out a bulb, it was an easy call. Now the difficult question; do we also add controls to optimize the lighting system? And if we do want controls, where do we begin? What will work for our parking deck?

Do We Need Controls?

The first question might not be whether or not we want to implement lighting controls, but whether or not we need to implement them. Depending on the location, the state or municipality may very well require basic lighting controls to meet ASHRAE 90.1 requirements (or Title 24 compliance in California). The overall intent of these standards is to ensure that, as a society, we are minimizing unnecessary energy expenditures, as determined by these governing bodies. The goal is to reduce energy consumption per capita, which is often achieved through regulation. The first step is to know whether we’re actually required to have a control system. Keep in mind, this broad range of standards covers retrofits as well as new construction.

Do We Want Controls?

The next thing we have to ask ourselves is whether we want controls to manage our lighting system and to what degree. In our world of high technology, embedded systems, and mobile devices, we have a plethora of choices to make when deciding exactly how we want our lights controlled. When evaluating lighting control systems, they fall into two categories: Sensor Networks and Services.

Sensor Networks

Sensor networks deploy strategies for minimizing our energy bill, namely occupancy detection and daylight harvesting. Nothing new here, but the decision-making comes into play in how sophisticated or intelligent we want that sensor network to be. Basically, our options are as follows:

System A: One-Way Communication

- A car enters the parking lot, tripping an occupancy sensor

- Sensor sends a control signal to a group of luminaires, declaring occupancy in the space

- Luminaires increase light output to safely illuminate the occupant’s path

- Occupant exits the area, causing the sensor to enter a state of non-occupancy, dimming the lights accordingly

In this scenario, the only system feedback we receive is a reduction in our energy bill. But if our budget is tight, and we simply want to enjoy enhanced energy savings while complying with regulations, this approach will do. If we desire more information from our system, then we’ll want System B.

System B: Two-Way Communication

- A car enters the parking lot, tripping an occupancy sensor

– Sensor records and timestamps the event - Sensor sends a control signal to a group of luminaires, declaring occupancy in the space

– Luminaire(s) sends acknowledgement to the sensor that the message was received - Luminaires increase light output to safely illuminate the occupant’s path

– Light output measured and recorded - Occupant exits the area, causing the sensor to enter a state of non-occupancy, dimming the lights accordingly

– Sensor records and timestamps when system moved back into non-occupancy state

– Occupancy events, power consumption, occupancy duration, etc. tracked and sent to central control unit for data processing

From the occupant’s perspective, System B’s functionality is identical to that of System A. The value of the data is to us, as the owner, because we now have metrics telling us whether our investment is operating as intended. We can also determine traffic patterns from the system data, including when the parking lot is being used, and how much energy the lights are consuming. Using this basic information, we can further configure our system to minimize energy consumption, while ensuring the space is safely and securely illuminated for our patrons.

Whether we choose a one-way or two-way (data feedback) communication network, we need to consider the protocol. Essentially, the protocol a system utilizes is the language executed to communicate between devices (sensors, controllers, light fixtures, etc.). We have two protocol choices; 1) an open protocol (e.g. DALI, ZigBee, etc.), which allows devices from multiple manufacturers to communicate on the same network, or 2) a proprietary protocol, which is typically exclusive to a single manufacturer. A network using an open-protocol is attractive from a competitive price standpoint because we have multiple controls vendors from which to choose. The advantage of a proprietary protocol is that each device on the network was designed and tested to be compatible, so we can be confident in the communication and performance of the system. Since a proprietary system is from a single manufacturer, we only have one phone call to make if we experience a system malfunction.

Services

This is where lighting gets fun. The lighting industry is experiencing a renaissance as it comes to grips with a convergence of technologies beginning with the LED. LED luminaires present two distinct advantages over traditional lamp options: 1) the light source is a semiconductor, which provides for easier integration into embedded systems, and 2) its location. Since data can now be provided by the sensor network, we can take that information and send text or email alerts to maintenance personnel, notifying them of a system disruption. Once that email alert is received, maintenance can locate the specific luminaire on a virtual lighting layout via their internet browser. And speaking of location, luminaires can also provide application-specific services to parking patrons. With intelligent lighting (located everywhere) we can track available parking spaces in a structure or lot, creating efficient notifications to inbound customers looking for an open spot. But why stop there? Once parked, why not deploy a mobile app that guides patrons from their car into the facility and back again once their visit has concluded? In essence, our lighting system can act as a local satellite network, providing services unique to a particular application.

Conclusion

The lighting landscape has changed, there’s no longer a simple answer as to whether we want lighting controls. We now have to ask ourselves a series of questions:

- Do regulations require I purchase lighting controls?

- Do I want my system to provide data?

- Are email and text alerts important to my operation?

- Are there other services I can provide with my lighting system?

- What support or warranty does the lighting control manufacturer provide?

The last question is critical. As the industry grapples with the technology shift, an unprecedented number of start-ups are jumping into the fray with warranties longer than the lifespan of the company. Remaining diligent in vendor selection and asking a few probing questions can lead to a beneficial controls solution that will positively impact our monthly cash flow—saving energy while providing a unique experience for the customer. When we show a friend our new smartphone, we delightfully talk about its apps, camera quality, user interface, and so on. The conversation then ends with, “and by the way, it makes pretty good calls too”. We’ll soon talk about our lighting features in a similar manner…and by the way, the quality of light is pretty good too!